Medical Liens & Subrogation in Maine Injury Cases

Health insurance, MaineCare/Medicaid, Medicare, ERISA plans—and why your settlement may shrink

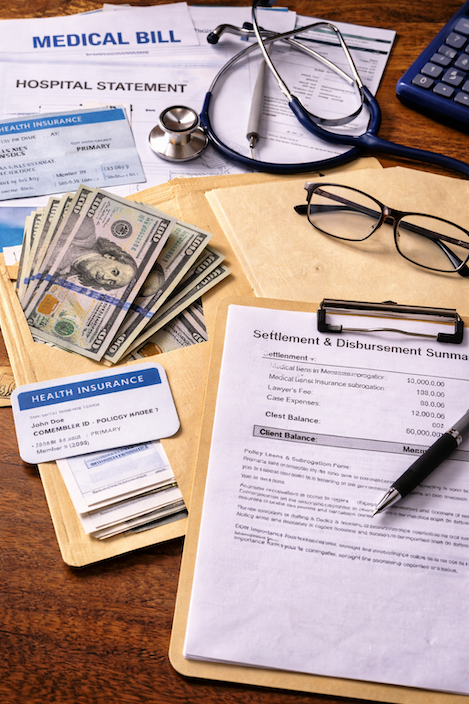

After an injury, you focus on treatment. Your health plan pays the hospital. MaineCare covers therapy. Medicare pays “conditionally” while your claim stays pending. Months later, you settle your injury case—and you expect the settlement check to cover what the injury cost you.

Then the letters arrive: reimbursement, lien, subrogation, right of recovery.

These claims can reduce your net settlement dramatically if you don’t identify them early and manage them carefully. Below is a plain-English roadmap to how medical liens and subrogation work in Maine injury cases, which payers have special rights, and what experienced counsel does to protect your recovery.

What “medical liens” and “subrogation” mean (and why they matter)

In a personal injury case, “liens” and “subrogation” usually describe a third party’s attempt to get repaid for medical bills they already paid.

- A lien often attaches to settlement proceeds and demands repayment from the recovery itself. MaineCare’s statute expressly creates a statutory lien on settlement proceeds in many cases.

- Subrogation means the payer steps into your shoes to recover what it paid from the party who caused the injury (or from your recovery).

Either way, the result often looks the same: the settlement gets reduced by repayment claims before you ever see the money.

Health insurance reimbursement in Maine: the “normal” rules—and the surprises

Private health insurers frequently assert reimbursement rights through plan language (the contract you accepted when you enrolled). They may claim:

- reimbursement (repay us from your settlement), or

- subrogation (we can pursue the at-fault party).

In many Maine cases, negotiation revolves around fairness doctrines and fee-sharing—especially when your attorney created the recovery.

The common fund doctrine can reduce reimbursement

Maine’s highest court adopted the common fund doctrine in York Insurance Group of Maine v. Van Hall, holding that when your attorney creates a recovery fund that benefits the insurer, the insurer should share reasonable attorney’s fees rather than free-ride on your work.

Auto “medical payments” coverage has its own Maine statute

If your reimbursement demand comes from auto medical payments (MedPay) coverage, Maine law limits how that insurer can claim priority and requires protections. A MedPay subrogation provision generally needs, among other things, your written approval and must account for the insurer’s pro rata share of attorney’s fees incurred in obtaining the recovery.

Practical impact: not all “liens” carry equal weight. The payer’s legal basis—auto MedPay vs. health insurance vs. government payer—changes how much leverage you have to reduce the claim.

MaineCare (Maine’s Medicaid program): statutory lien and aggressive recovery tools

MaineCare has some of the strongest lien language you’ll see in a Maine injury case.

Maine law provides that the commissioner’s right to recover the cost of MaineCare benefits:

- includes subrogation to the extent of benefits paid,

- can become a statutory lien on settlement proceeds when medical costs “were or could have been included” in the claim,

- allows the Attorney General (or appointed counsel) to pursue recovery if needed, including proceedings against people who received settlement funds.

The statute also explains how MaineCare evaluates recovery and compromise:

- MaineCare may recover “to the extent that there are proceeds available” after deducting reasonable attorney’s fees and litigation costs from the gross settlement.

- In deciding whether collection is “cost-effective,” the commissioner may consider factors that reduce value, including comparative negligence, liability defenses, trial risk, and insurance limits.

- The commissioner may compromise or waive claims in whole or part at the commissioner’s discretion.

Important twist: MaineCare’s lien statute states that the lien “may not be reduced” to reflect a pro rata share of the recipient’s attorney’s fees or litigation costs (although the statute separately discusses recovery “after” fee/cost deduction and allows discretionary compromise).

Federal Medicaid limits still matter

Because MaineCare is Medicaid, federal law can limit what portion of a settlement a state Medicaid program can reach. The U.S. Supreme Court held in Ahlborn that Medicaid recovery cannot exceed the portion of a settlement attributable to medical expenses.

More recently, the Supreme Court held in Gallardo v. Marstiller that the Medicaid Act permits recovery from settlement amounts allocated to future medical care as well.

Practical impact: settlement allocation and documentation matter. A careful approach can prevent an overreach and support a fair reduction where the law allows it.

Medicare: “conditional payments” and a formal recovery process

Medicare does not wait politely at the end of your case. When Medicare pays injury-related care while a liability claim is pending, it often treats those payments as conditional and expects reimbursement.

CMS describes a structured process that typically begins with reporting the case to the Benefits Coordination & Recovery Center (BCRC) and continues through identification of Medicare payments and the demand stage.

Medicare’s rules can affect not only you, but also insurers:

- CMS’s Medicare Secondary Payer (MSP) guidance explains that Medicare may pursue recovery even if parties settle privately and can pursue insurers in some situations, including potential double-damages exposure under MSP enforcement concepts.

Medicare also recognizes procurement cost reductions in appropriate cases—meaning it may reduce its recovery to reflect the costs of obtaining the settlement.

Practical impact: you need to identify Medicare’s payments early, challenge unrelated charges, and close the file correctly. Medicare mistakes and timing issues can delay settlement distribution.

ERISA health plans: why some reimbursement claims feel “non-negotiable”

Some employer-sponsored health plans fall under ERISA (federal benefits law). ERISA plans often include strict reimbursement language, and federal decisions give substantial weight to the plan’s written terms.

The Supreme Court held in US Airways, Inc. v. McCutchen that the plan’s terms generally govern and equitable defenses cannot override clear reimbursement language—though courts may use equitable principles to fill gaps when the plan is silent on a point.

The Court also held in Montanile that an ERISA plan may not be able to recover from a participant’s general assets after the participant dissipates specifically identifiable settlement funds (depending on the facts and tracing).

Practical impact: ERISA plans can present the toughest reimbursement fights. You often win (or lose) these disputes based on plan wording, timing, and how settlement funds are handled.

How lawyers actually reduce liens and reimbursement claims

A strong lien strategy doesn’t rely on one magic argument. It relies on process and proof:

- Identify every payer early (health insurance, MedPay, MaineCare, Medicare, ERISA plan administrators).

- Demand the basis for the claim (contract language, statute, itemized payment ledger).

- Audit the charges (remove unrelated treatment, duplicates, coding errors).

- Preserve allocation support (medical specials vs. wage loss vs. pain and suffering) where the law makes allocation relevant.

- Use Maine-specific fee-sharing rules where applicable (common fund and MedPay statutory protections).

- Negotiate with documentation (comparative negligence, policy limits, litigation risk—factors MaineCare itself may consider for compromise).

- Resolve Medicare properly through the established process so settlement funds don’t sit in limbo.

Talk with Peter Thompson & Associates

Medical liens and subrogation can take a big bite out of a settlement—especially when multiple payers demand reimbursement at once. Peter Thompson & Associates helps injured Mainers identify lienholders early, challenge improper charges, negotiate reductions where the law allows, and resolve Medicare and MaineCare issues so clients can receive their net recovery sooner.

If you have questions about a lien letter, reimbursement demand, or how much of your settlement you may actually keep, contact Peter Thompson & Associates for a confidential case review.